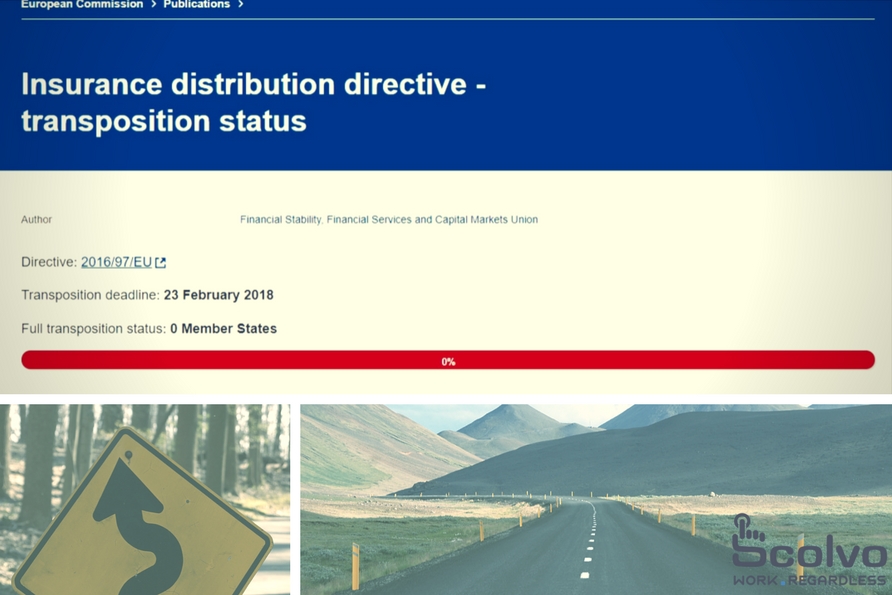

A week before the original deadline of February 23, the European Commission has agreed to a delay of the implementation date of an important new rule for the insurance sector. The new deadline that will affect the national markets is October 1, but the respective local legislations should be adjusted by July 1, 2018. Let’s see how the different countries prepared for the Insurance Distribution Directive.

In a best-case scenario, three months from now all the countries of the EU will have transposed a regulation of their own to comply with the rules of the Insurance Distribution Directive (IDD).

The market players, on the other hand, will have seven months to prepare for the implementation.

The draft laws and amendments are ready in most of the countries we covered below, and the market players that had complained about the shortage of implementation times now are more likely to make headway in their implementation projects.

CEE Market Snapshots

The Czech Republic

In the Czech Republic, the elections held in the autumn set back the legislation processes, and it may be still set back by a dysfunctional parliament in 2018. So it is yet to see whether the country manages to fulfill its transposition obligations with the IDD on time. Fincentrum’s Legal and Compliance Director Vladek Krámek claimed the efficiency of the new regulation for the sector would come with “approximately one year delay.”

Slovakia

The Slovak Republic has already approved the necessary modifications to the Financial Intermediation and Financial Advice Act, to transpose the IDD into national law. However, the negotiations with the financial intermediary sector did not lead to the desired outcome, from the sector’s perspective. The Association of Financial Intermediaries and Financial Advisers finds it positive to see changes in commission rules but expresses concerns over the guarantees of professionalism of agents.

Croatia

The Ministry of Finance in Croatia is already done preparing the amendment to the current insurance law and waiting for it to be approved. On a recent conference, the Croatian Insurance Days, top professionals of the sector discussed the possible consequences of the regulation, together with the challenges they’re facing. Andreja Radic Blazin, Head of Insurance at the Supervisory Agency of the Croatian Financial Services, said that, despite the scarcity of sophisticated products on the market, it would still not be so easy to comply with the IDD requirements for the distributors. Generali CEE’s CFO added that the fast-changing technology landscape might make compliance a double challenge.

Poland

The final version of the act was approved by the Sejm on November 9, 2017, and passed on to the Senate. If it will also accept it, and the President signs it, the original timeframes can be kept, and the act will come into force by February 23, 2018. Depending on the decision of the EU about pushing the implementation deadline further, the Polish legislator might also have some room to adjust the dates, CMS Law-Now reports. Sooner or later, market players will need to comply with the new act, and if they fail at it, the penalties might amount to as high as 5% of their revenues.

Hungary

Hungary has already published the amendments to its Insurance Act in November, containing the necessary changes for the transposition of the IDD. Besides the act coming to effect on February 23, 2018, several regulations of the European Commission regarding the details of the implementation of the directive will be legally binding for the market players. In a recent roundup, CEO’s of the leading financial institutions considered IDD one of the most substantial challenges of 2018 but hoped that the interest of the customer would justify the efforts.

Romania

The Ministry of Finance has published the draft law for the transposition of the IDD in Romanian legislation in September. After the Parliament has it approved, the bill will come into force on February 23, 2018, and cancel all the previous regulations regarding insurance distribution in the country.

Germany and Austria

The German Parliament was way ahead of the other in approving the country’s IDD Implementation Act in July 2017. The state will be the only one to keep a prohibition of passing on insurance provisions so to protect insurance intermediaries are from decreasing margins and the need to close more deals to make up for that.

Contrary to the German preparedness, Austria was still to send a draft bill in December with the amendments to the current laws affected by the IDD. The Ministry of Economics needs to have the Industrial Code and possibly other laws updated.