Insurers are soon to face another probe regarding a recent regulation: besides the already known GDPR, the sector will have to comply with the Insurance Distribution Directive (IDD) of the EU. Digitalization and mobility offer a viable solution to that problem.

It’s time to comply again: The European Union gave a two-year timeframe for the individual countries to adjust their legal regulations to and ratify the so-called Insurance Distribution Directive (IDD) and that expires on 23 February 2018. From then on, market players will most likely have another 7 months to implement the changes in their practices.

The IDD would like to enforce the rights of the customers on an EU-level to receive the same complete information package about an insurance product, including agent fees (that is also the most discussed part of the regulation), regardless of the sales channel. Also, the European Union would like to establish a detailed rule of the requirements necessary for the work of agents and distributors and to create a standard regulation for life and non-life insurance products.

For the insurers, it is the last minute to prepare for the changes to come in February 2018. According to the general opinion in the sector, compliance is hardly achieved in this timeframe unless the service providers find a quick and “painless” solution.

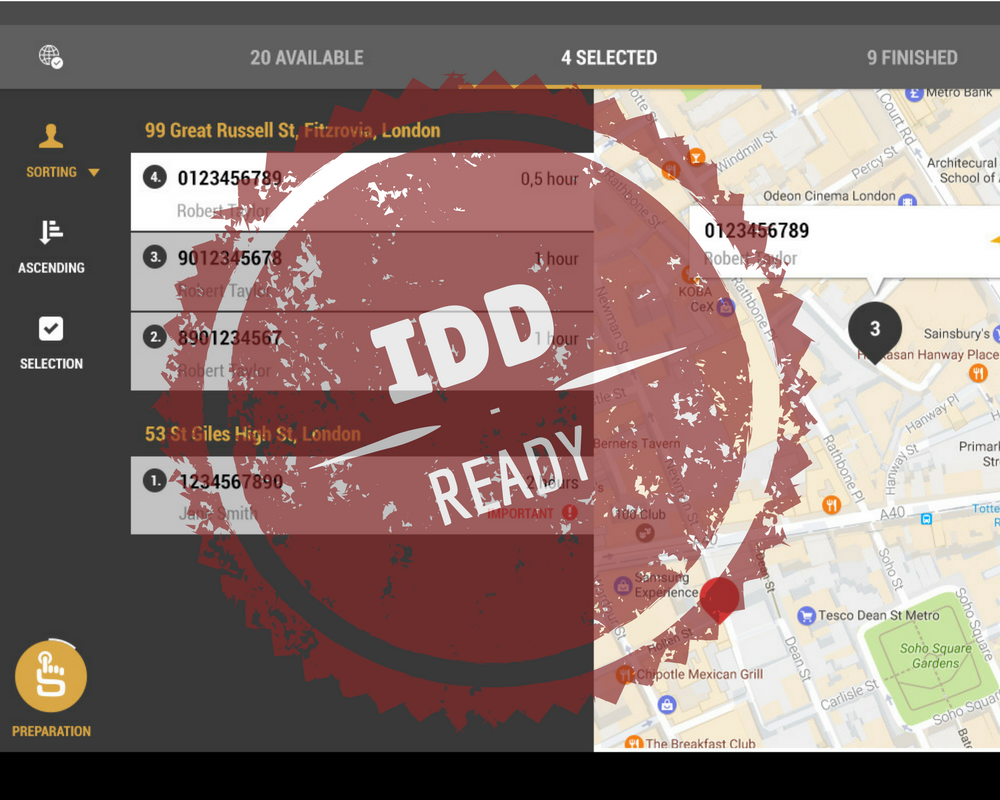

Luckily, there are such solutions available: mobile sales enablement tools. These are a great help in the digitalization process, not only supporting paper-free processes but also follow-ups, as they document them automatically (making them compliant with regulations). The easily accessible, digital documents are also of crucial importance for customer engagement.

Let’s see what exactly do insurers have to comply with and what advantages does a mobile sales enablement tool have regarding this compliance:

Even More Information Material

The EU member countries, especially the more mature economies, are covered on most levels with their existing regulations. The sale of insurance products had also been regulated on an EU-level by the Insurance Mediation Directive, applicable to brokers and other intermediaries (this will be replaced by IDD). However, the current directive now significantly extends the obligations to all sellers of insurance and requires them to commit to helping clients even more to make informed decisions. To most service providers, complying with the IDD might be a considerable challenge.

A substantial part of the directive is the obligation to provide a standardized and straightforward documentation about the insurance product (IPID). The documents need to meet the content requirements (detailed description of the product, meeting client demand, the costs, interaction, and risks of the individual elements) and also the formal ones (equally readable in color and monochrome print, not too small letters, availability of more languages on demand).

Help Comes on Mobile

A mobile sales enablement application will help insurance distributors making their workflows digital (therefore, paperless), but also easy to follow up and to reach an overall higher level of customer engagement, while meeting all requirements of the directive.

Let’s go through the details of how a mobile app makes the life of insurance agents and sales managers easier:

Pre-set workflow

A mobile sales enablement application can define the steps an agent has to follow during a personal meeting. This way, the margins of error can be reduced to a minimum: the agent will undoubtedly present all necessary documents (it is especially important in the case of complimentary insurance products that can be implemented as extra elements in the workflow), in the right form. He or she can also check whether the message has been successfully delivered, and give a suitable offer. Since the application saves a record of the whole process and the agents authenticates it with their signatures, it is retrievable and controllable.

Questionnaires

Mobile questionnaires are particularly suitable to make sure, even during a presentation, that the client has received the right information and understood it, including the risks associated with a particular product. With a questionnaire, agents can assess a client’s general financial knowledge, situation, and goals, and adjust their offers accordingly. The filled out forms can be accessed in the application anytime, and they can also be shared with the back-office in real-time so, in the case of the occasional checkup, the agent’s work is adequately documented.

Presentations

The up-to-date presentations are always at hand, in a form that is attractive to the client, with interactive elements on demand. Interactive displays are especially useful when it comes to presenting the individual components and different risks in an offer. The content of the presentation can be modified and specified by using the data put in by the clients and aggregated by the app. This way, it will be even more suitable for the client demand assessment required by IDD and will contribute more efficiently to the preparation of an offer that meets that demand.

Notes

With the mobile sales app, agents can take notes about the attached documents, whether they are standardized product leaflets, multilingual materials, questionnaires filled out by the clients, or specific slides of a presentation. If there was also a consultation, notes taken during such a meeting could also be sent to the client in a pdf format, together with other attachments, meeting the requirement of pre-contract delivery.

Access to client data

The mobile app is a one-stop shop for all data regarding a client, a consultation or a contract. Examples of the data include details of a personal meeting, presentations, documents (scanned documents can also be attached), completed questionnaires, quotes made by the agent, and full legal notices.

Calculators and product recommendations

Personalized quotes can be created by the agent anywhere with the mobile application and the integrated calculators and product recommendation services. For more complex calculations, special third-party services can also be integrated into web-based or native versions. The recommendation engines usually ask questions based on keywords in the official documents and compare the options using the answers given.

Quotes and on-site contracting

The mobile sales enablement application can create a personalized quote for the client already on-site of the personal meeting, following the consultation and the delivery of the documents. If the client accepts the offer, whether it is done by signing a piece of paper or by an e-signature, the deal can be closed by both the agent and the client while complying with the IDD.

We at SCOLVO have developed a mobile sales enablement application that supports personal sales processes and answers the challenges of the insurance sector by simplifying consultants’ everyday tasks. By using SCOLVO Sales, the sales process becomes digital and, at the same time, compliant with the regulatory requirements of proper documentation, follow-up, and quality customer service.